Academic Factor Evaluation Guide (AcaEvaluatorModel & AcaIndirectEvaluator)

1. What is AcaEvaluatorModel?

AcaEvaluatorModel tests the explanatory/predictive power of academic (or self-built) factors on stock returns. It connects factor portfolio time series with individual stocks’ excess returns, and provides:

- Time-series regressions (Rolling/Expanding): obtain per-period coefficients, intercept (α), and statistics;

- Cross-sectional regressions: run a cross-sectional regression at each timestamp to examine the exposure–return relation;

- Fama-MacBeth regressions: two-step estimation of cross-sectional prices, producing mean β and t-statistics;

- Parallelization and sliding window control, suitable for mid-sized panels (Time × Stock).

Classic workflow (copy-paste ready)

# 1) Base data

from firefin.data.gateway import fetch_data

import pandas as pd

import numpy as np

data = fetch_data(['market_cap','return_adj','pb_ratio','open','close','volume'])

rf = pd.read_feather('path/to/us_bond_2y.feather') # Example risk-free rate

# 2) Select sample and derive indicators

mkt_cap = data['market_cap'].iloc[50:470, :100]

ret_adj = data['return_adj'].iloc[50:470, :100]

pb = data['pb_ratio'].iloc[50:470, :100]

bm = 1 / pb

# Align risk-free rate and build excess returns

rf = (rf.set_index('datetime') if 'datetime' in rf.columns else rf)

rf = rf['us_bond_2y']; rf.index = pd.to_datetime(rf.index).normalize()

rf = rf.reindex(mkt_cap.index.normalize(), method='ffill') / 100

rf.index = mkt_cap.index

risk_free_rate = rf

excess_ret = ret_adj.sub(risk_free_rate, axis=0).fillna(0)

# 3) Example: use PB for univariate sorting and take H−L as the factor portfolio

from firefin.core.algorithm.portfolio_sort import PortfolioSort

forward_returns = {0: ret_adj}

pb_quantile_ret = PortfolioSort.single_sort(

factor=pb, forward_returns=forward_returns, quantiles=5, market_cap=mkt_cap

)

# Take H−L and wrap as list[pd.Series]

pb_HML = [pb_quantile_ret[0].iloc[:, -1]]

from firefin.evaluation.academia.AcaEvaluatorModel import AcaEvaluatorModel

model = AcaEvaluatorModel(

factor_portfolio = pb_HML, # list[pd.Series]

return_adj = excess_ret, # Time × Stock

n_jobs = 10, # number of parallel workers

time_series_window = None, # pass None; set a window size here if you need rolling tests

all_time_series_regression = True, # True=single full-sample regression; False=sliding window

verbose = 1,

)

# 1) Time-series regression: rolling coefficients/intercept/residuals/statistics

ts_res = model.run_time_series_regression(fit_intercept=True)

# 2) Cross-sectional regression: explain stock returns each period

cs_res = model.run_cross_sectional_regression()

# 3) Fama-MacBeth: two-step estimation of cross-sectional prices

fm_res = model.run_fama_macbeth_regression()

2.1 Required inputs

factor_portfolio: list[pd.Series]A set of time series of factor portfolio returns (e.g., H−L, market factor, size factor, etc.). EachSeriesis indexed by date, and its length must equal the number of rows inreturn_adj.return_adj: pd.DataFrameThe matrix of individual stock returns, with shape Time × Stock. Index = dates, columns = stock tickers.

- Use

PortfolioSort.single_sort(...)to obtain quantile portfolio returns, then take the H−L column to form thepb_HMLlist;- Subtract the risk-free rate from individual stock returns to get excess returns

excess_ret;- Feed both into

AcaEvaluatorModel:basic_test = AcaEvaluatorModel( factor_portfolio = pb_HML, # list[pd.Series] return_adj = excess_ret # Time × Stock DataFrame )

2.2 Indexing & missing-value conventions

- Date indexes must be perfectly aligned (same frequency, no duplicates). It’s recommended to pre-handle missing values (

dropna/ forward-fill / mask columns). - If trading halts / IPOs within the window cause NaNs, the model will treat NaNs as 0 after ingestion.

Data preparation example:

# 1) Base data

from firefin.data.gateway import fetch_data

import pandas as pd

import numpy as np

data = fetch_data(['market_cap','return_adj','pb_ratio','open','close','volume'])

rf = pd.read_feather('path/to/us_bond_2y.feather') # Example risk-free rate

# 2) Select sample and derive indicators

mkt_cap = data['market_cap'].iloc[50:470, :100]

ret_adj = data['return_adj'].iloc[50:470, :100]

pb = data['pb_ratio'].iloc[50:470, :100]

bm = 1 / pb

# Align risk-free rate and build excess returns

rf = (rf.set_index('datetime') if 'datetime' in rf.columns else rf)

rf = rf['us_bond_2y']; rf.index = pd.to_datetime(rf.index).normalize()

rf = rf.reindex(mkt_cap.index.normalize(), method='ffill') / 100

rf.index = mkt_cap.index

risk_free_rate = rf

excess_ret = ret_adj.sub(risk_free_rate, axis=0).fillna(0)

# 3) Example: use PB for univariate sorting and take H−L as the factor portfolio

from firefin.core.algorithm.portfolio_sort import PortfolioSort

forward_returns = {0: ret_adj}

pb_quantile_ret = PortfolioSort.single_sort(

factor=pb, forward_returns=forward_returns, quantiles=5, market_cap=mkt_cap

)

# Take H−L and wrap as list[pd.Series]

pb_HML = [pb_quantile_ret[0].iloc[:, -1]]

- Evaluation

Goal: Use the pb_HML factor portfolio to explain individual stocks’ excess returns excess_ret.

from firefin.evaluation.academia.AcaEvaluatorModel import AcaEvaluatorModel

model = AcaEvaluatorModel(

factor_portfolio = pb_HML, # list[pd.Series]

return_adj = excess_ret, # Time × Stock

n_jobs = 10, # number of parallel workers

time_series_window = None, # pass None; set a window size here if you need rolling tests

all_time_series_regression = True, # True=single full-sample regression; False=sliding window

verbose = 1,

)

# 1) Time-series regression: rolling coefficients/intercept/residuals/statistics

ts_res = model.run_time_series_regression(fit_intercept=True)

# 2) Cross-sectional regression: explain stock returns each period in the cross section

cs_res = model.run_cross_sectional_regression()

# 3) Fama-MacBeth: two-step estimation of cross-sectional prices

fm_res = model.run_fama_macbeth_regression()

Regression result objects typically include: coefficients, intercept (α), residuals, standard errors, t-stats, and R².

# Accessing model outputs ts_res.beta # factor exposures from time-series regressions ts_res.tvalue # t-stats for factor exposures ts_res.alpha # intercept from time-series regressions ts_res.alpha_t # t-stat for the intercept ts_res.r2 # R^2

- API details (function I/O + tunable parameters)

This section clarifies the constructor and the three regression methods—their inputs, outputs, defaults, and constraints—and shows how to set parameters such as a custom time window.

4.1 Constructor AcaEvaluatorModel(...)

Signature

AcaEvaluatorModel(

factor_portfolio: list[pd.Series],

return_adj: pd.DataFrame,

n_jobs: int = 10,

time_series_window: int = 60,

all_time_series_regression: bool = True,

verbose: int = 0,

cov_type = None,

)

Parameter descriptions

| Parameter | Type/Shape | Default | Purpose | Constraints/Notes | Typical values/Advice |

|---|---|---|---|---|---|

| factor_portfolio | list[pd.Series]; each Series indexed by date with length = T (sample size). K = #factors. | Required | Provide time-series returns of factor portfolios (e.g., H−L, MKT, SMB …). Internally each factor is duplicated across return_adj’s columns to run regressions. | Each Series must have the same #rows as return_adj; index (dates) must align with return_adj.index; pre-handle missing values if possible. | If only 1 factor, still wrap in a list, e.g., [hml_series]. |

| return_adj | pd.DataFrame, shape = T × N (Time × Stock). | Required | Dependent variable: usually individual stocks’ excess returns (risk-free already subtracted). | Columns are tickers/IDs; index must fully align with all factors; consider handling missing or dropping columns with too many NaNs. | Use a single frequency (daily/weekly/monthly). |

| n_jobs | int | 10 | Parallelism for batched regressions (time-series / cross-sectional / FM). | Constrained by CPU cores & memory; parallel backends may vary across platforms. | Set to logical CPU count or slightly below. |

| time_series_window | int | 60 | Rolling window length. Only effective when all_time_series_regression=False. | If all_time_series_regression=True, the internal window becomes full sample length T; this parameter is ignored. | For monthly data 36 (3y); for daily 252, 504, etc. |

| all_time_series_regression | bool | TRUE | Whether to run a single full-sample time-series regression. | Set False to enable time_series_window for rolling regressions. | Use False for stability/time-varying analyses. |

| verbose | int | 0 | Logging verbosity. | 1 or 2 prints more progress. | Increase for debugging, lower for production. |

| cov_type | str | None | Covariance kernel type | None: standard i.i.d. residual assumption for t-stats; HAC: Newey-West t-statistics. |

4.2 Time-series regression run_time_series_regression(fit_intercept: bool = True, window = self.window, cov_type = self.cov_type)

# 1) Time-series regression: rolling coefficients/intercept/residuals/statistics

ts_res = model.run_time_series_regression(fit_intercept=True)

Inputs

fit_intercept: bool = True: whether to estimate the intercept (α).window: int = 60: regression window size.cov_type: str = None: which covariance kernel to use.

Outputs/Return

- Returns and saves to

self.time_series_res: a batched time-series regression result object fromRollingRegressor. - Exact fields depend on implementation; common ones (subject to implementation):

coef/beta(per time × per factor × per stock, or aggregated);intercept/alpha,stderr,tvalue/pvalue,r2,resid;- Possible exporters:

to_frame()/to_xarray()/summary().

Custom window

- Control via the constructor:

# Full-sample once:

AcaEvaluatorModel(..., all_time_series_regression=True)

# Rolling 120 periods:

AcaEvaluatorModel(..., all_time_series_regression=False, time_series_window=120)

Usage tips

- Check whether

alphasignificantly deviates from 0; - Examine stability of rolling

beta; - Beware multicollinearity among highly correlated factors; using kernel type

"HAC"is recommended.

4.3 Cross-sectional regression run_cross_sectional_regression()

# 2) Cross-sectional regression: explain stock returns each period

cs_res = model.run_cross_sectional_regression()

Inputs

- None (all dependencies come from the parameters set in

AcaEvaluatorModelinitialization, such astime_series_window,cov_type,fit_intercept).

What it does internally

- Calls

cross_sectional_regression(self.time_series_res, self.return_adj, window=self.time_series_window, skip_time_series_regression=True, n_jobs=self.n_jobs, verbose=self.verbose, cov_type = self.cov_type). - The typical flow uses individual stock exposures/loadings from the previous step as regressors at each time, and runs cross-sectional OLS on stock returns to obtain per-period coefficients and statistics.

Outputs/Return

BatchRegressionResult:- Contains per-timestamp cross-sectional coefficients,

intercept,stderr / tvalue / pvalue,R².

- Contains per-timestamp cross-sectional coefficients,

4.4 Fama-MacBeth regression run_fama_macbeth_regression()

# 3) Fama-MacBeth: two-step estimation of cross-sectional prices

fm_res = model.run_fama_macbeth_regression()

Inputs

- None (all dependencies come from the parameters set in

AcaEvaluatorModelinitialization, such astime_series_window,cov_type,fit_intercept).

What it does internally

- Calls

FamaMacBeth.run_regression(self.time_series_res, self.return_adj, window=self.time_series_window, skip_time_series_regression=True, n_jobs=self.n_jobs, verbose=self.verbose, cov_type = self.cov_type), executing the two-step procedure:- Obtain exposures from the time-series regression;

- Run cross-sectional regressions over time, and summarize average risk prices (λ) and their significance (common practice uses time-series-correlation-robust standard errors, e.g., Newey-West/HAC).

Outputs/Return

BatchRegressionResult(aggregated two-step results):- Average λ (risk prices) per factor, their

t/pvalues, and the significance of theintercept.

- Average λ (risk prices) per factor, their

5.1 Constructor AcaIndirectEvaluator.__init__(...)

Typical workflow (copy-paste ready)

from firefin.data.gateway import fetch_data

import pandas as pd

import numpy as np

data = fetch_data(['market_cap','return_adj','pb_ratio','open','close','volume'])

rf = pd.read_feather('path/to/us_bond_2y.feather') # Example risk-free rate

# 2) Select sample and derive indicators

mkt_cap = data['market_cap'].iloc[50:470, :100]

ret_adj = data['return_adj'].iloc[50:470, :100]

pb = data['pb_ratio'].iloc[50:470, :100]

bm = 1 / pb

# Align risk-free rate and build excess returns

rf = (rf.set_index('datetime') if 'datetime' in rf.columns else rf)

rf = rf['us_bond_2y']; rf.index = pd.to_datetime(rf.index).normalize()

rf = rf.reindex(mkt_cap.index.normalize(), method='ffill') / 100

rf.index = mkt_cap.index

risk_free_rate = rf

excess_ret = ret_adj.sub(risk_free_rate, axis=0).fillna(0)

# Build momentum signal

mom_signal = (data["close"] / data["close"].shift(21) -1).shift(1).iloc[50:470, :100]

# Example: use PB for univariate sorting and take H−L as the factor portfolio

from firefin.core.algorithm.portfolio_sort import PortfolioSort

forward_returns = {0: ret_adj}

pb_quantile_ret = PortfolioSort.single_sort(

factor=pb, forward_returns=forward_returns, quantiles=5, market_cap=mkt_cap

)

# Take H−L and wrap as list[pd.Series]

pb_HML = [pb_quantile_ret[0].iloc[:, -1]]

from firefin.evaluation.academia.AcaIndirectEvaluator import AcaIndirectEvaluator

# Create AcaIndirectEvaluator

pb_HML_indirect_test = AcaIndirectEvaluator(factor_portfolio=pb_HML,

return_adj=ret_adj,

risk_free_rate=risk_free_rate,

stock_size=mkt_cap,

stock_value=bm,

mom_signal=mom_signal)

# GRS robustness (window must be > N + K)

pb_HML_indirect_test.evaluate_stability(mode = "ff3_mom",window = 110)

from firefin.evaluation.academia.AcaIndirectEvaluator import *

# Build quantile returns

quantile_ret = [pb_quantile_ret[0][col] for col in pb_quantile_ret[0].columns]

# Create AcaIndirectEvaluator

indirect_test = AcaIndirectEvaluator(factor_portfolio=quantile_ret,

return_adj=ret_adj,

risk_free_rate=risk_free_rate,

stock_size=mkt_cap,

stock_value=bm,

mom_signal=mom_signal)

# 1) Benchmark comparison (last-period α/β + adjusted R²)

indirect_test.evaluate_by_other_factors(mode = "ff3_mom")

# 2) Cumulative α trajectory (expanding window)

indirect_test.cumulated_alpha(mode = "ff3_mom")

# 3) One-click LaTeX table (includes CAPM, FF3+MOM, custom)

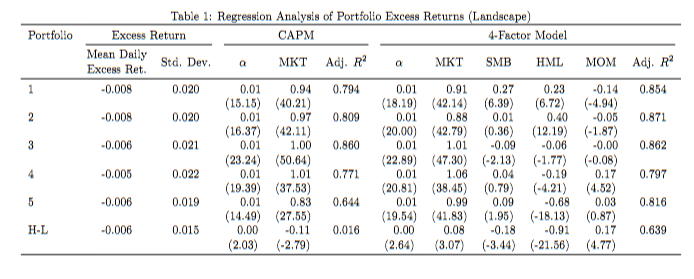

latex_str = indirect_test.export_evaluation_table()

Signature

AcaIndirectEvaluator(

factor_portfolio: list[pd.Series],

return_adj: pd.DataFrame,

time_series_window: int = 60,

all_time_series_regression: bool = True,

*,

risk_free_rate: pd.Series,

stock_size: pd.DataFrame, # market cap (for size weighting / constructing benchmarks)

stock_value: pd.DataFrame | None = None, # book-to-market (BM)

op: pd.DataFrame | None = None, # operating profitability (RMW-related)

ag: pd.DataFrame | None = None, # asset growth / investment (CMA-related)

mom_signal: pd.DataFrame | None = None, # momentum signal

n_jobs: int = 10,

verbose: int = 0,

)

Parameters (only new/specific ones listed; others same as §4.1)

| Parameter | Type/Shape | Requirement | Purpose/Notes | Typical values/Notes |

|---|---|---|---|---|

| risk_free_rate | pd.Series (T×1) | Required | Risk-free rate; used to form excess returns and benchmark factors. Index aligned with data. | Same unit/frequency as return_adj (e.g., monthly). |

| stock_size | pd.DataFrame (T×N) | Required | Market cap time series; for constructing MKT/SMB and weights. | Align with return_adj; fill missing as needed. |

| stock_value | pd.DataFrame (T×N) | Depends on mode | BM values; required for mode=”ff3” or “ff3_mom” or “ff5”. | Can use 1/pb_ratio. |

| op | pd.DataFrame (T×N) | Required for ff5 | Profitability indicator (RMW-related). | Keep frequency/definitions consistent. |

| ag | pd.DataFrame (T×N) | Required for ff5 | Investment/asset growth (CMA-related). | Same as above. |

| mom_signal | pd.DataFrame (T×N) | Required for ff3_mom | Momentum signal; to construct WML/MOM factor. | Common choices: 12-1 or 6-1 momentum. |

Indexing requirement: All the above time indexes must fully align with

factor_portfolio/return_adj. Internally the implementation commonly usesfillna(0)for simplicity, but in practice, proper preprocessing is recommended.

5.2 Benchmark “modes” & factor bundles (bundle_*)

evaluate_by_other_factors / cumulated_alpha / evaluate_stability choose the pricing model via mode:

| mode | Meaning | Required inputs | Internal call | #factors k (example) |

|---|---|---|---|---|

| “capm” | CAPM (market factor) | risk_free_rate, stock_size | bundle_capm(…) | 1 (MKT) |

| “ff3” | Fama–French 3-factor | also needs stock_value | bundle_ff3(…) | 3 (MKT, SMB, HML) |

| “ff3_mom” | FF3 + Momentum | also needs stock_value, mom_signal | bundle_ff3_mom(…) | 4 (MKT, SMB, HML, MOM) |

| “ff5” | Fama–French 5-factor | also needs stock_value, op, ag | bundle_ff5(…) | 5 (MKT, SMB, HML, RMW, CMA) |

| “customize” | Custom factor set | needs factor2: list[pd.Series] | use factor2 directly | Determined by the passed factors |

If required inputs are missing, a

ValueErrorwill be raised (implemented in code). The.nameattribute of benchmark factor series will be used for result column names.

5.3 Method 1: evaluate_by_other_factors(...)

Purpose: For each portfolio return, run OLS (single full-sample) under the chosen mode, and return the last period’s coefficients, t-values, and adjusted R².

Signature & parameters

evaluate_by_other_factors(

mode: Literal["capm","ff3","ff3_mom","ff5","customize"] = "capm",

factor2: list[pd.Series] | None = None,

)

mode: see §5.2;factor2: required only whenmode="customize"; custom factor list (indexes must align; setnameattributes).

Return values

coefficient_df : pd.DataFrame # [alpha, factor betas] for each portfolio at the *last period*

statistics_df : pd.DataFrame # [alpha_t, factor t-values] at the same period

r2_adj_series : pd.Series # adjusted R^2 for each portfolio’s regression (single full-sample)

# Row index: portfolio names (from self.factor_portfolio[i].name)

# Columns ordered as: ["alpha", *factor_names]

Core implementation points

- Stack chosen factors

customized_factor_listintox(shape approx.(k, T, 1)), and for each portfolioy, runRollingRegressor(...).fit(window=None)(i.e., a single full-sample regression). - Take

res.alpha.iloc[-1],res.beta.iloc[:,0].valuesas the “last period” coefficients; similarly obtainalpha_tandtvalue. - Adjusted R² computed manually: , where

nis sample size andkis #factors.

Example

coef, tval, r2a = indirect.evaluate_by_other_factors(mode="ff3_mom")

# Custom:

my_factors = [carry, value_signal, quality]; [f.rename(n) for f,n in zip(my_factors,["CARRY","VAL","QTY"])];

coef_c, tval_c, r2a_c = indirect.evaluate_by_other_factors(mode="customize", factor2=my_factors)

Interpretation

alphainsignificantly different from 0 ⇒ the portfolio return is well explained by the benchmark;- Significant

alpha≠ 0 ⇒ potential anomalies/omitted factors; - Larger

R²_adj⇒ stronger explanatory power; comparing modes (adding HML/MOM/RMW/CMA) shows whether α vanishes.

Regression coefficients:

alpha MKT

1 0.007082 0.944907

2 0.007462 0.965323

3 0.009172 1.004914

4 0.010420 1.013731

5 0.008710 0.832304

H-L 0.001629 -0.112603

t-statistics:

alpha MKT

1 15.150826 40.209226

2 16.366894 42.114703

3 23.239453 50.643657

4 19.391861 37.525036

5 14.493777 27.546402

H-L 2.031361 -2.793442

Radj2R^2_{adj}:

1 0.794081

2 0.808820

3 0.859527

4 0.770553

5 0.643951

H-L 0.015978

5.4 Method 2: cumulated_alpha(...)

Purpose: Expanding-window regressions over time to track the evolution of α as the sample grows; can plot or return the time series.

Signature & parameters

cumulated_alpha(

mode: Literal["capm","ff3","ff3_mom","ff5","customize"] = "capm",

factor2: list[pd.Series] | None = None,

starting_point: int = 20,

plt: bool = True,

)

starting_point: start estimating α once the sample size reaches this number (no estimates before it);plt: ifTrue, callplot_cumulative_alphato plot; ifFalse, returnlist[pd.Series](one α curve per portfolio, aligned with original dates).

Return values

plt=True: directly plots, no return;plt=False:list[pd.Series](Series name = portfolio name).

Implementation details

- For each

i = starting_point … T: take sample 0..i, run a full-sample regression (RollingRegressor(..., window=None)), and record the last-period α from that regression; - This yields the time series “α(i)”, i.e., the stability trajectory of α as the sample expands.

Interpretation

- If the α curve converges to 0 with decreasing volatility ⇒ the abnormal return weakens with a longer sample/more comprehensive benchmarks;

- If α stays stably positive/negative and significant ⇒ a more credible pricing anomaly or model omission.

5.5 Method 3: evaluate_stability(...) — Rolling GRS robustness

Purpose: Rolling robustness evaluation based on the GRS joint test. Tests whether, under given benchmark factor sets, the α of all tested assets (here, the stock cross section) are jointly zero.

Signature & parameters

evaluate_stability(

value_weighted: bool = True, # not directly used for now; reserved for extensions

mode: Literal["single","capm","ff3","ff3_mom","ff5"] = "single",

window: int = 30,

plt: bool = True,

)

mode="single": use only the “tested portfolio itself” as an explanatory variable (equivalent to testing whether this portfolio can explain individual stocks’ excess returns);- Other

modevalues: concatenate the chosen benchmark factors with the “tested portfolio”, and explain the stock excess returns together; - Window requirement:

window > N + K(the code checksmin_win = N + K + 1), whereN= number of stocks andK= #regressors (benchmark factors + #tested portfolios).

Return values

plt=True: returnsplot_grs_pval(grs_pval_series)(plot object);plt=False: returnspd.Seriesnamed"grs_pval"with date index (aligned, front-filled as needed).

Implementation notes

- Assemble regressors:

single⇒concat_return = factor_excess_ret(tested portfolio only);- otherwise ⇒

concat_return = factor_list + factor_excess_ret(benchmarks + tested portfolio).

- Use

RollingRegressor(window=window)to regress the stock excess return matrix, and obtain per-periodbetaandalpha; - Compute the GRS p-value in each rolling window: large p ⇒ fail to reject “α jointly zero”; small p ⇒ significant unexplained α remains.

Interpretation

- High p-values (e.g., >0.95, blue line in figure): benchmark + tested portfolio explain the stock-level returns well; joint α is insignificant;

- Low p-values: significant abnormal returns remain within that window ⇒ insufficient explanatory power or weak stability.

5.6 Method 4: export_evaluation_table(...) — One-click LaTeX table export

Purpose: Summarize return statistics and regression results (CAPM, FF3+MOM, optionally custom) into a single LaTeX table (for papers/reports).

Signature & parameters

export_evaluation_table(

mode: str = "daily", # frequency: daily, monthly, yearly

customized_factor: list[pd.Series] | None = None,

) -> str

Internal flow

- Compute each portfolio’s excess return

excess_ret = portfolio - risk_free_rateand summarize:summarize_returns; - Regressions:

mode="capm"results:mkt_df, mkt_stats_df, mkt_r2_adj;mode="ff3_mom"results:ff4_df, ff4_stats_df, ff4_r2_adj;- If

customized_factoris provided, runcustomizeas well;

- Use

stitch_coeff_tvalue(...)to combine coefficients + t-values into MultiIndex columns (two levels per column:(factor_name, coeff|tvalue)); - Call

latex_table(...)to produce the final LaTeX string and return it.

Return

str: write to.texor paste into your paper; includes:- Return statistics (mean/std);

alpha/βand their t-values for each model;R²_adjper model.

Other functions

AcademicFactors

This project provides convenient constructors for classic academic factors: ff3, ff5, ff3+mom, returning a list of [pd.Series] (the project’s standard factor structure).

from firefin.evaluation.academia.AcademicFactors import *

ff3 = bundle_ff3(stock_return = ret_adj,

size = mkt_cap,

book_to_market = bm,

market_cap = mkt_cap,

risk_free_rate = risk_free_rate)

ff5 = bundle_ff5(stock_return = ret_adj,

size = mkt_cap,

book_to_market = bm,

market_cap = mkt_cap,

profitability = profitability,

investment = investment,

risk_free_rate = risk_free_rate)

ff3_mom = bundle_ff3(stock_return = ret_adj,

size = mkt_cap,

book_to_market = bm,

market_cap = mkt_cap,

momentum_signal = momentum_signal,

risk_free_rate = risk_free_rate)

For individual academic factors, the project also provides dedicated constructors:

# Market factor

mkt = market_excess(stock_return = ret_adj, size = mkt_cap, risk_free_rate = risk_free_rate)

# HML factor

hml = hml(stock_return = ret_adj, size = mkt_cap, book_to_market = bm)

# SMB factor (ff3 and ff5 versions slightly differ)

smb_ff3 = smb_ff3(stock_return = ret_adj, size = mkt_cap, book_to_market = bm)

smb_ff5 = smb_ff5(stock_return = ret_adj, size = mkt_cap, book_to_market = bm, profitablity = profitability, investment = investment)

# Momentum factor

mom = mom(stock_return = ret_adj, size = mkt_cap, momentum_signal = momentum_signal)

cross_sectional_regression

This project can run cross-sectional regressions on factors alone and return regression parameters.

from firefin.core.algorithm.cross_sectional_regression import *

xs=cross_sectional_regression(ff3, excess_ret,cov_type="HAC",window=50)

Here you can set the rolling window window as needed. cov_type specifies the method for computing t-statistics. cov_type=None gives standard OLS t-statistics; cov_type="HAC" computes Newey-West t-statistics.

Fama macbeth regression

This project can run standalone Fama-MacBeth regressions on factors and return regression parameters.

from firefin.core.algorithm.fama_macbeth import *

fm=FamaMacBeth.run_regression(ff3, excess_ret,window=50)

You can set the rolling window window here as well.